Episode 21: Get Aboard the taXchain! Solving Global Taxes for Supply Chains and Logistics

- Mike J. Walker

- May 19, 2020

- 10 min read

Updated: May 20, 2020

In this episode we have five guests, yes, five. A V-Next first. They come from 2 global German companies you may of heard of, Siemens and Henkel. We talk about their ambitious goals to create taXchain, an inclusive digital ecosystem, their journey, and their lessons learned along the way.

🎧 Listen in Here

Introduction to Blockchain in Trade Management

Digitalization is the fourth industrial revolution. The digital and the physical world are merging, though the digital and real economy. Looking into trade, the combination of information and material flow will be affected by this. Information management, will move more and more into cyberspace, while the physical material flow remains. In other words, paper based document will disappear by digital alternatives. In trade management customs information give material an identity, like the characteristics of a human being that are documented in a passport. Consequently there are high requirements for customs data to ensure validity, consequently some processes and information exchange is still paper-based with respective signatures. However, blockchain technology can overcome security respectively genuine concerns and deliver a digital proof of identity for customs data, blockchain technology has the power to create a fully secured digital passport for material.

Why taXchain?

There are many different processes in the tax, customs & trade area that require change. Through new technologies there is a lot of potential to digitalize – for example – inefficient and heavy paper-based processes, that are defined by authorities in order to provide proof of ‘original’ documents.

Following this train of thought Henkel and Siemens tax departments started to look into the process of long term supplier declarations, which provides information on the origin of material that is needed to decide if a product is eligable for a free trade agreement or not. Compared to the business traveler, this means if a person needs a visa to enter into a country or if the persons enjoys preferential treatment, for example under a visa waiver program.

Henkel, Siemens and Microsoft build a first blockchain solution that can manage the process of long term supplier declaration. With this solution the companies intend to digitalize their trade data management in terms of efficiency, robustness, and control. This applies inbound, when receiving trade certificates but also outbound, when issuing trade certificates. Via the blockchain trade certificates can be issued, revoked and checked in real-time. From an authority perspective this provides better insight and efficiency gains in confirmation of preference calculations while offering opportunities for lean administration and automated certification processes. Industry-wide the transformation of this process has the potential to increase control up- and downstream the supply chain and to simplify administrative processes among trading partners. The benefits expected to reduce process costs by more than 80% while increasing process robustness.

The solution of Henkel, Siemens and Microsoft, is a starting point, currently introduced a digital clone to existing processes. This pioneering concept and prototype has the potential to start the digital transformation of customs processes together with authorities and business partners. Imagine, the vision of a digital material passport becomes real, the identity of material is fully proofed and customs procedures could be automated like a self service check out - only by passing the gate, customs declarations and procedures will be automatically handled.

LTVDs: Our First Opportunity

Your first use case is issuing and demanding Long-Term Supplier Declarations. With your digital solution you also see the potential to digitalize trade data management in terms of efficiency, robustness, and control, which will provide information on the origin of material that is needed to decide if a product is eligible for a free trade agreement or not.

What.LTVDs certify relevant master data information between buyers / sellers for up to 24 months: Country of Origin, HS Code, FTA Application

Why. Data enables frictionless cross-border sales and opens savings opportunities (i.e., Free Trade Agreements)

Who. All multinational enterprises buying, selling, and producing tangible products across borders.

Goal.Move paper based process into Blockchain to ensure compliance while streamline the process.

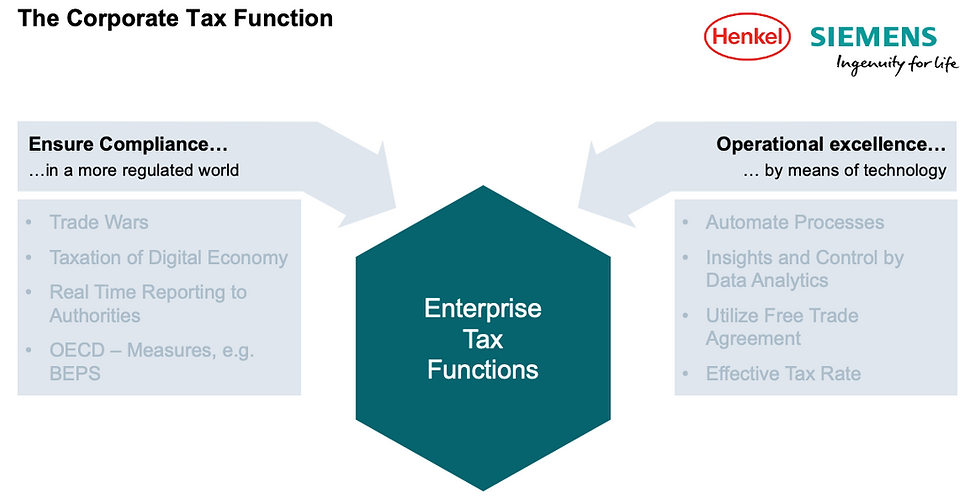

When asked about what largest challenges in the tax industry was and what do you think is necessary to overcome them here were the key points from both Andre and Robert:

Extensive documentation requirement by laws especially after the OECD BEPS initiative

A lot of paperwork in the area of Trade/Customs/duties

Digitizing businesses requires the same effort in Tax and Trade functions

We have to work in processes to be able to digitize our function

Currently a mixture of paper work and emails between entities plus a lot of process interfaces and different ERP systems

Challenge is to really manage the digital change together with the people

Laws tend to change faster and become more complex and international, esp. for European Community

Transformation of the processes

Gain deeper insights and control by data analytics

Improve utilization of Free Trade Agreement

Aim real time reporting also to authorities

The Approach They Used to Build a Durable Digital Ecosystem

As many of us have come to find out building one of these digital ecosystems become incredibly complex and can cause you to go down the wrong path fairly easily. This is due to the incredibly dynamic and configurable nature of these digital ecosystems.

What's required to get this clarity is to ensure that you've got the right business strategy in place with all the corresponding enabling decisions that need to be made.

What I helped the team through was understanding the following decisions that needed to be made. Both Andre and Robert led the charge (along with others) to have 1:1's and workshops to derive these decisions:

Strategy. Member company(ies) direct investments to execute strategy and deliver business outcomes.

Legal Requirements. Specific industry, business, geographical legal requirements that will influence the type of governance.

Business Model Definition. What type of business model are they trying to establish now and long-term. How aggressive do they want to be with their strategy (ex: maverick, fast follower, laggard)?

Ecosystem Business KPIs. What are the business outcomes measures for success. Looking for quantifiable and qualifiable statements.

Investment structure. What is the investments planned or made and what’s the ROI plan to achieve.

Value Model. Defined strategic business performance indicators. Investments and rationalization against strategic requirements and business outcomes. Identification of new revenue streams or cost optimization.

Risk Management Requirements. Adherence to corporate and legal guardrails determined by each current or future member company. Definition of risk appetite versus innovation needs.

Operational Performance Requirements. Monitoring metrics while the ecosystem is in operation. Should tie to the investment returns, cost effectiveness, and the achievement of business long-term outcomes.

Resourcing Available. The defined allocation and capacity of funding, resourcing, or assets to realize the business outcomes of the ecosystem.

Current Governance Frameworks Used. What are the frameworks that the member companies use today? Are there any mandates? Legal or regulatory requirements? Preferences?

As Olga stated, how we got these answers was with an enormous amount of collaboration with business leaders, lawyers, risk managers, enterprise architects, and more.

Here is an example business envisioning workshop agenda that helps tease out these decisions when they are not known or immediately obvious.

Another vital task was to collect this information and organize it in a meaningful way. The "Digital Ecosystem Business Case" agreement sets the overall governance framework for the blockchain-enabled digital ecosystem. It will address and settle all issues that might hamper the smooth and seamless cooperation of the different members.

As a governed ecosystem, the business case can resolve many of the legal uncertainties that may inhibit widespread adoption of the ecosystem. However, the form of governance must not itself raise new intractable issues and a precise but flexible dispute resolution mechanism will be crucial to its success.

This digital ecosystem business case is meant to be more than a statement of lofty aspirations but rather define the economic benefits, business considerations, governance model, and legal ramifications of membership.

The specific legal agreements for formation and other legally binding issues are handled in separate documents. This digital ecosystem business case provides the vital input for the formation of the legal agreements between the ecosystem and potential members to set out the rights and obligations amongst themselves.

Below are the contents of a Digital Ecosystem Business Case

Once the business case is completed to the appropriate level of detail, the anchor for all decisions going forward is the business model of the ecosystem. There are many ways to approach digital ecosystems here are the four primary digital ecosystem business models. As you will see, level of control or trust and scope are vital components of the decision.

There are many additional aspects that can be covered in later podcasts that pick up from here.

taXchain Value Proposition

The tax community in Germany is a fairly close one. They have had a long working relationship in which we talk time by time about latest developments in our area of responsibilities.

After discussing some of the frustrations in their industry it was that they had a similar vision how to digitize our tax and trade functions. They had a very clear direction and starting point from the beginning with the idea of delivering these capabilities quickly:

Analysis of manual processes

Looking for a clear and manageable use case, start with CoO but extended quickly to Long Term Supplier Declarations (LTSD)

Looking for a robust processes solution to ensure regulatory compliance and control

The rational for this is that it's extremely risky to deliver an entire tax platform all at one time. Starting with Long Term Supplier Declarations provided the ability to work closely with a partner to drive out requirements but also the analysis required for "Country of Origin" documents was a straightforward and easy process to learn and prove the technology. Given that this was a well known process along with the requirements it has allowed the team to move quickly and add value faster.

They did evaluate other solutions in the market before building this. However, they felt that these existing solutions were way too restrictive for an open tax platform.

Problems and Opportunities

For Siemens and Henkel the value and/or problems that taXchain solves includes:

taXchain is a collaborative platform to get started i.e. we will invent more than ONE use case on this platform

Replace manual processes, reduce interfaces by ensuring regulatory compliance and control

Many players benefit by one workflow

Set an industry standard for blockchain solutions within tax and customs to also realize other use cases e.g. CoO documents, PoD, energy tax etc.

Challenges

There were a number of challenges to overcome in the tax industry. Some of those included:

A great deal of trade, customs, and duties documentation that is required by laws especially after the OECD BEPS initiative

Digitizing businesses requires the same effort in Tax and Trade functions

We have to work in processes to be able to digitize our function

Currently a mixture of paper work and emails between entities plus a lot of process interfaces and different ERP systems

Challenge is to really manage the digital change together with the people

Laws tend to change faster and become more complex and international, esp. for European Community

Transformation of the processes

Gain deeper insights and control by data analytics

Improve utilization of Free Trade Agreement

Aim real time reporting also to authorities

Technology and Project Management

The taXchain ecosystem had a dedicated project manager that was able to coordinate efforts across the two companies along with multiple stakeholders. Their blockchain journey was segmented in these major stages:

Envision

Formation

Incubation

Operation

taXchain has passed the Envision and Formation and ready to rollout controlled pilots in waves. Now in the incubation stage, where we hone it for use in production. One big task is an interconnection with internal systems and scaling up.

Example timeline below.

This hasn't gone without technical hurdles along the way. Here are the top five technical challenges have been:

In the enterprise area blockchain is still not widespread

And some architectural patterns have to be adopted for enterprise world

Being prepared to easily integrate the various enterprise resource systems (easily connect ERP systems)

In the enterprise area blockchain is still not widespread

And some architectural patterns have to be adopted for enterprise world

For the technology platform they have chosen to use the Microsoft Azure Blockchain Service. There were some very specific reasons why they choose this blockchain platforms over others:

Most extensive breadth and depth of mature, reliable cloud services to power Blockchain applications

Azure Blockchain Workbench for quick MVP, Marketplace

Extensible support and services from MS

Managed service over unmanaged / compare to self-hosted

MS is preparing managed service with Hyperledger Fabric

Conclusion

For the team, they had learned some valuable lessons along the way. Here are their top insights:

Managing two different companies was a lot harder than we thought initially

Organizing an international effort was a logistic challenge especially trying to get meetings booked with the different time zones.

It's difficult to find highly qualified blockchain experience

This was a lot of fun to manage despite the challenges

Make sure the solution is not over-engineered and is fit for purpose

Working with Microsoft was smooth

Implement use cases that are capable to other scenarios and use cases

Despite the rumors, the technology runs quite quickly

However, the business model, governance structure and legal requirements are time consuming and must be well thought trough.

Start early to elaborate one the business needs.

Make sure to implement a cross functional team of tax, legal and IT experts from the beginning and always involve the people who later one should work with the solution.

Carefully design the architecture so that support the extensibility and scalability of the platform .

For more information please contact the team at: taxchain.de@siemens.com

Bios

Andre Rubbert

• Accountant at Coopers & Lybrand Deutsche Revision AG (C&L)

• Principal Consultant at PricewaterhouseCoopers (PwC)

• Partner at Siemens Inhouse Consulting for Supply Chain and Manufacturing

• Global Head of Service Management Logistics at Siemens Shared Services

• Head of Export Control & Customs Methods and Standards Siemens AG

• Head of Digital Tax Transformation Siemens AG

Prof. Dr. Robert Risse

Robert Risse, lawyer and financial advisor, is the head of the Tax and Trade department of Henkel AG & Co. KGaA since 2000 and is globally responsible for all topics and projects related to taxation and customs. He's a member of the board of the Rhein-Ruhr discussion group (so called “IFA West”) and a member of the tax advisory examining board at the Ministry of Finance of North Rhine-Westphalia. He is also the honorary professor for tax compliance and applied tax planning chaired by Prof. Carmen Bachmann for business taxation at the University of Leipzig.

Dr. Olga Chatelain

Olga Chatelain works for Siemens IT in Application Platform and Digital Solutions. Manager and consultant with a wealth of international experience in leadership, technical sales, projects, development and human resources. She holds a PhD degree in mathematical modelling (applied science) for power plants. Passionate about new technology and digitalization with a business use case driven mindset.

Proshanta Sarkar

Proshanta Sarkar works for Henkel as a Blockchain Engineer for Digital Business. He is member of Blockchain practice at Henkel and his main responsibilities are to identify and execute various Blockchain projects at Henkel. He holds a Master of Technology(M.Tech) degree in Computer Science and Engineering. He is very much passionate about new technologies, ideas, and innovation. With many years of experience on Blockchain technology he always tried to solve some of the early technological challenges of Blockchain and has published many disclosures. Visit him https://www.linkedin.com/in/proshantasarkar/

Thomas Parsch

Thomas Parsch works as an IT consultant for the Digitalization Enablement Center at Siemens AG.

He holds a Master of Science in Informatics with the Technical University of Munich and studied one year abroad at KAIST in South Korea. His interests are Software Development and forming agile DevOps teams.

He is one of the main drivers of new digitalization projects in various business areas from Finance to Deep Sea Engineering. One example is an evolved blockchain solution, which is already in use at over one hundred suppliers of rolling stock components.

Comments